-

Personal

Borrowing

-

Business

-

About

-

Community

Community Giving

Grants

StellerStudents

Volunteering

Newsletter

At the end of last year, we made a commitment to our members to take noticeable steps forward, in an effort to improve and modernize our credit union – with the ultimate goal of providing the best possible options in rural BC banking. A major piece of this is centered on the accounts that we offer – and we are confident that our new account line-up will meet the needs of any potential member.

Please select the type of accounts you wish to see below.

For ease of comparison, the list below shows all personal chequing accounts, however, only those highlighted in green are impacted by the upcoming change.

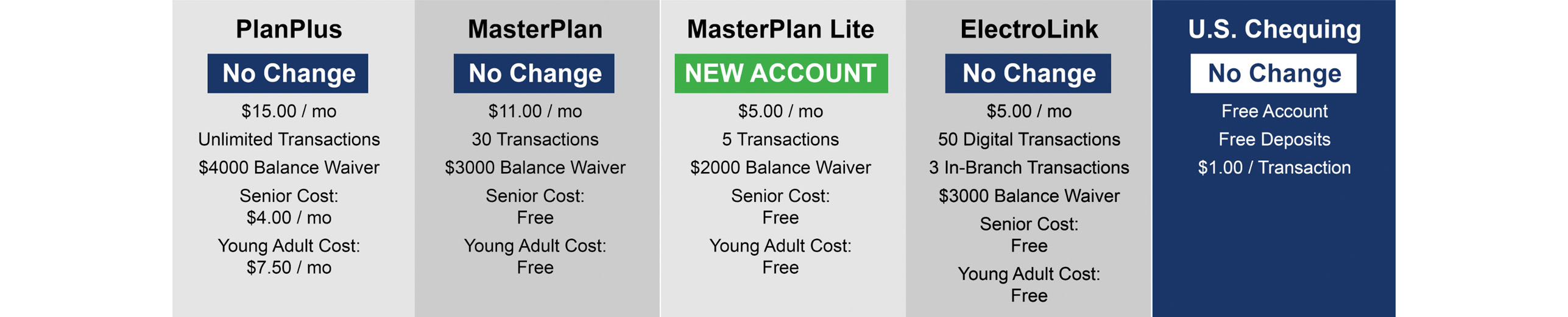

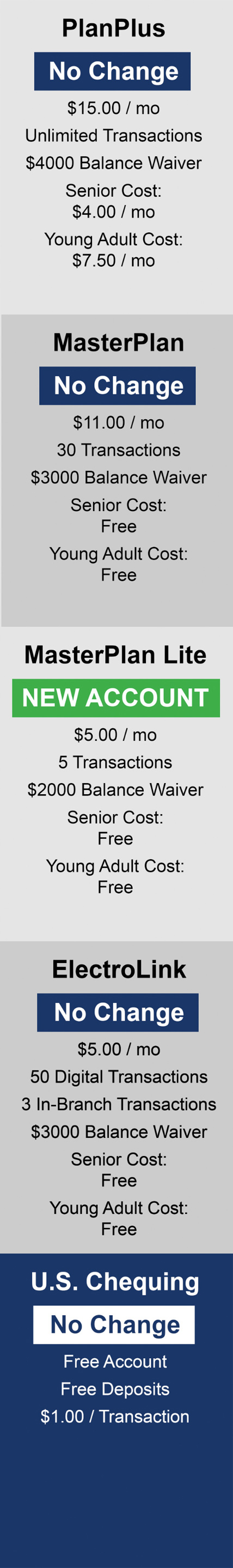

Personal Chequing Accounts

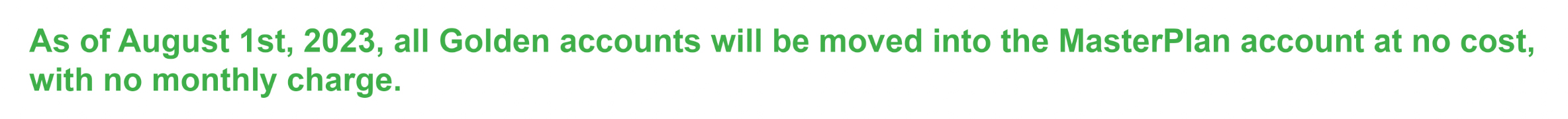

We are excited to announce our new approach to senior banking. We will be eliminating the need for special seniors’ accounts, and instead granting free and discounted access to all of our accounts. This means that any senior can access any account they wish, at a Golden rate, instead of being given only a single account option.

This change requires no action by the member, and while it does come with a slight drop in transactions, from 40 to 30, senior members who do a lot of banking can now access unlimited banking for just $4.00/month by moving to our PlanPlus account. Senior access to unlimited banking was not previously available, and we are pleased to be offering this at a rate much lower than our competitors. No action is required by members, as this change will be automatic.

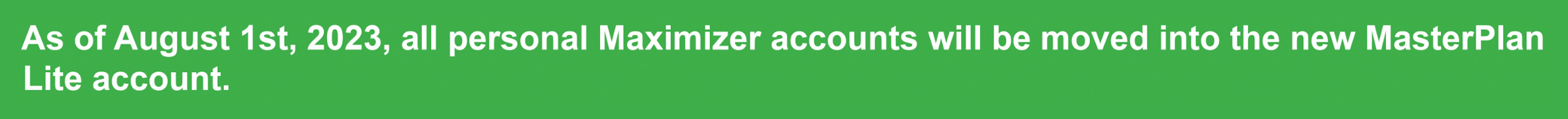

Grandfathered Account: Maximizer

Part of product improvement process is to move members from grandfathered accounts into our new and active accounts. This important step ensures that all members can enjoy equal access to the latest and greatest, while enabling our banking system to securely store, protect, and leverage information. By making this transition, we are addressing direct member feedback on the importance of timely and relevant advice and will significantly enhance our ability to deliver on this front.

While members will be losing the interest rate (currently 0.01%), they will gain access to 5 monthly transactions, which were not previously included - a five-dollar value. No action in required by members, as this change will be automatic.

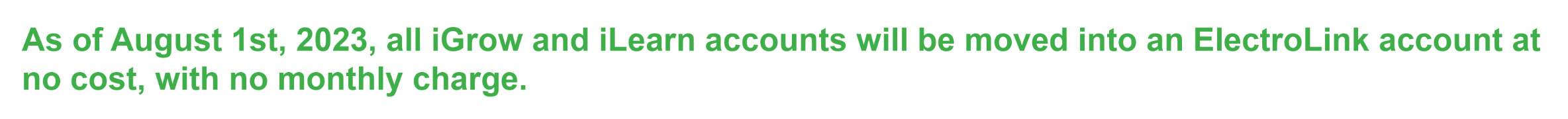

We are excited to announce our new approach to banking for young adults. We will be eliminating the need for any special accounts, and will instead be granting free and discounted access, to all of our accounts, for everyone under the age of 25. This means that any young adult can access any account they wish, at a free or discounted rate, instead of being given only a single account option.

This change requires no action by the member, and still grants everyone in these accounts access to 50 self-serve transactions each month. Young Adults looking for more traditional, in-person, banking options can request a move into the MasterPlan account at no charge, or can move into unlimited banking, via our PlanPlus account, for just $7.50 per month. No action is required by the member, as the change will be automatic.

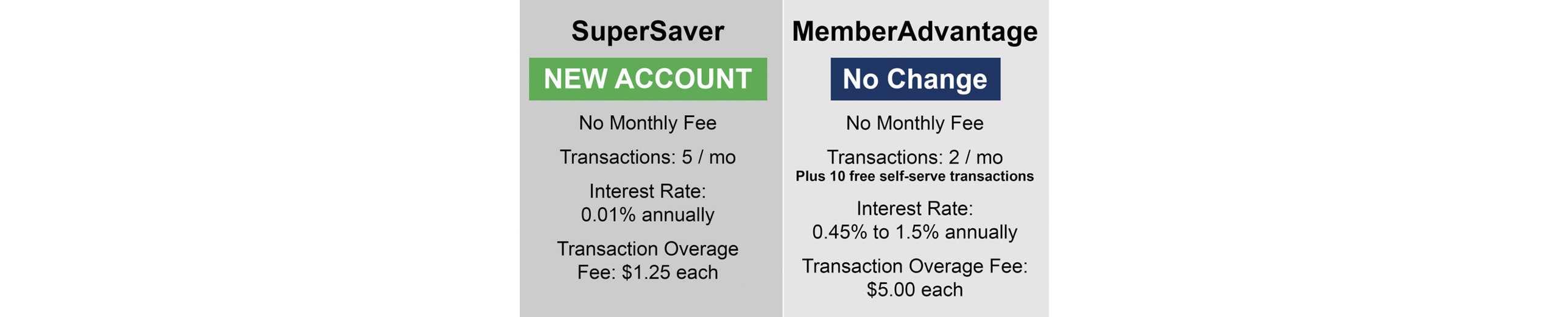

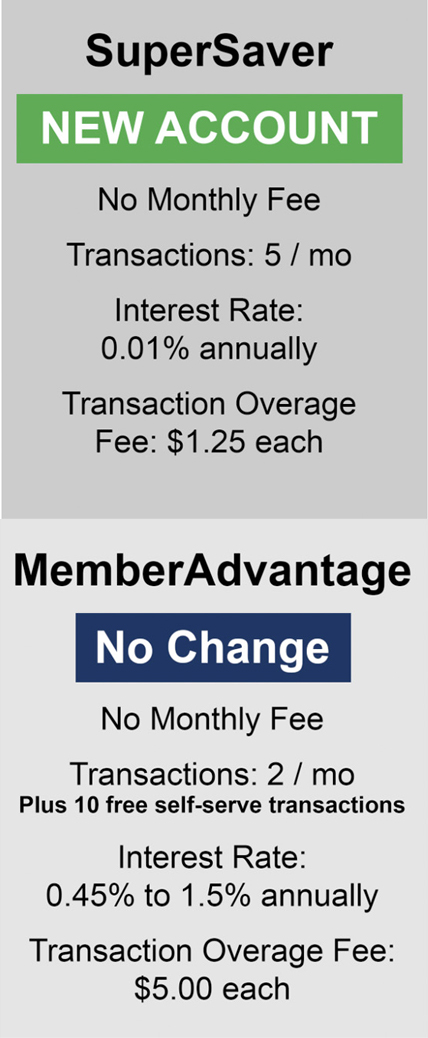

For ease of comparison, the list below shows all personal savings accounts, however, only those highlighted in green are impacted by the upcoming change.

Personal Savings Accounts

Personal Savings Accounts

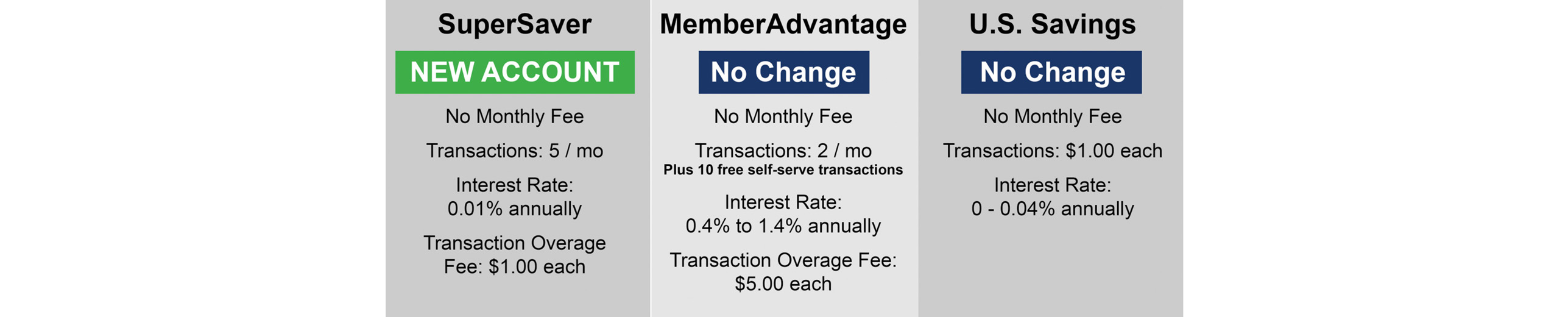

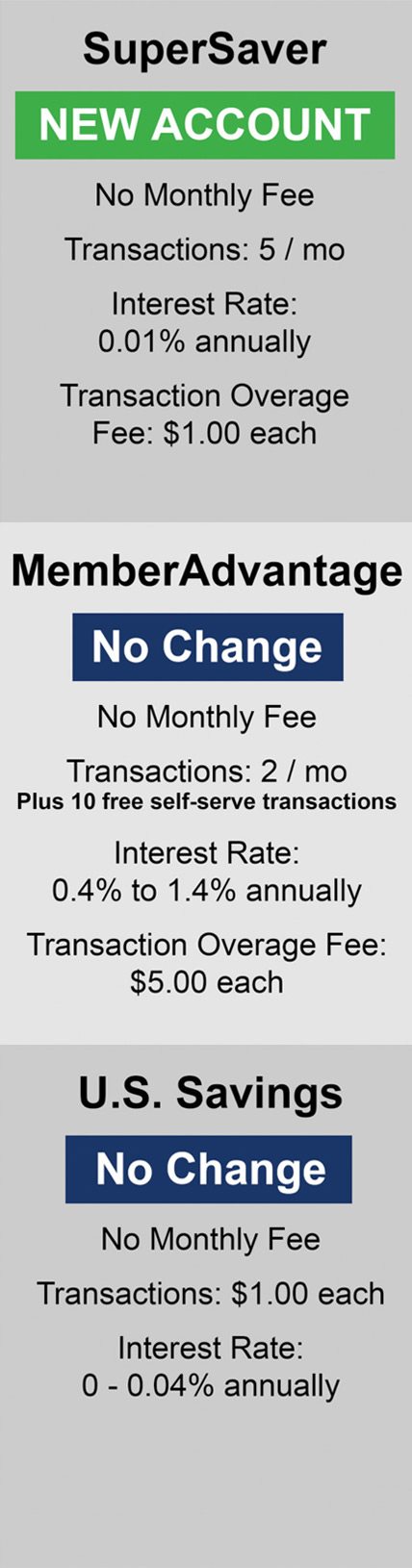

Grandfathered Accounts: SuperSaver, SuperSaver JR, SuperSaver Golden, SuperSaver Staff

Part of product improvement process is to move members from grandfathered accounts into our new and active accounts. This important step ensures that all members can enjoy equal access to the latest and greatest, while enabling our banking system to securely store, protect, and leverage information. By making this transition, we are addressing direct member feedback on the importance of timely and relevant advice and will significantly enhance our ability to deliver on this front.

Members being moved from existing and grandfathered SuperSaver products into this updated account will see either no change to their monthly fee, or a reduction – in all cases, there is no monthly account fee moving forward. Moving forward all members in a SuperSaver will have access to five free transactions per month. No action is required by the member as this change is automatic.

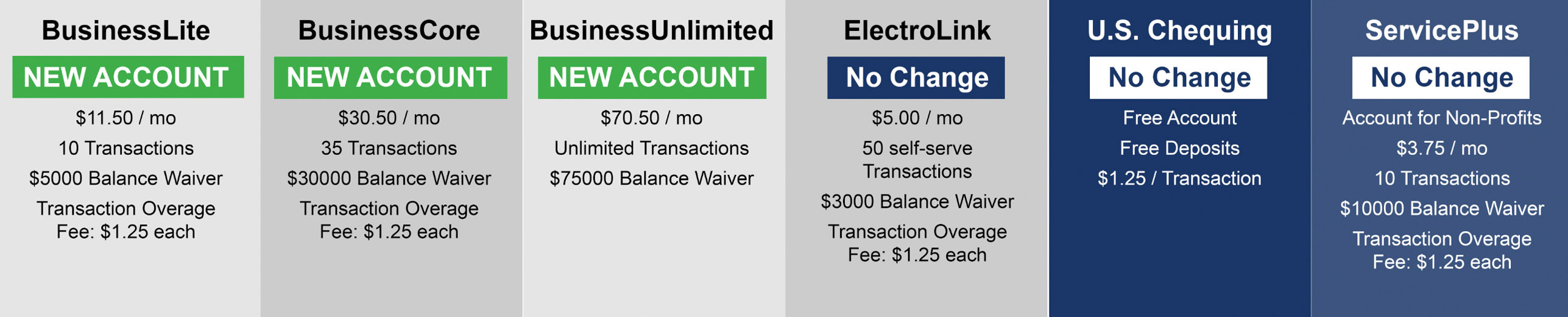

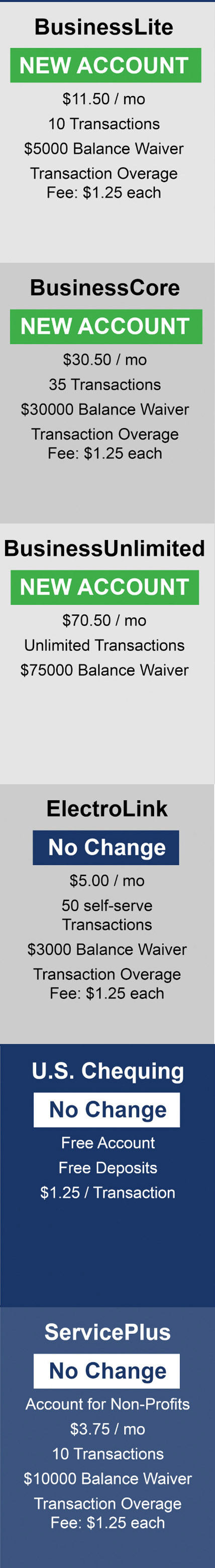

For ease of comparison, the list below shows all business chequing accounts, however, only those highlighted in green are impacted by the upcoming change.

Business Chequing Accounts

Business Chequing Accounts

The goal in these changes to our commercial banking account line-up is to create more value for members, while delivering clear options for various levels of banking. The B10 and B20 changes represent a consolidation of these two products – into BusinessLite. While B20 members will benefit from a much lower balance waiver in the BusinessLite account, they may wish to move into the BusinessCore account if they expect to conduct more than 10 transactions in a month. No action is required by the member, this change will be automatic.

The goal in these changes to our commercial banking account line-up is to create more value for members, while delivering clear options for various levels of banking. The B35 and B50 changes represent a consolidation of these two products – into BusinessCore. While B20 members will benefit from a much lower balance waiver in the BusinessCore account, they may wish to move into the BusinessUnlimited account if they expect to conduct more than 35 transactions in a month. No action is required by the member, this change will be automatic.

The goal in these changes to our commercial banking account line-up is to create more value for members, while delivering clear options for various levels of banking. The B100 and B200 changes represent a consolidation of these two products – into BusinessUnlimited. All business members in this move will be gaining access to more transactions at a lower cost. No action is required by the member, this change will be automatic.

For ease of comparison, the list below shows all business savings accounts, however, only those highlighted in green are impacted by the upcoming change.

Business Savings Accounts

Business Savings Accounts

Part of product improvement process is to move members from grandfathered accounts into our new and active accounts. This important step ensures that all members can enjoy equal access to the latest and greatest, while enabling our banking system to securely store, protect, and leverage information. By making this transition, we are addressing direct member feedback on the importance of timely and relevant advice and will significantly enhance our ability to deliver on this front.

While some members being moved from the Business Savings account into the Business SuperSaver may see a slight reduction in interest, all members will see a monthly fee reduction of $2.50 and will gain access to five free transactions per month. Any member seeking higher interest can select the Business MemberAdvantage account at any time. No member action is required, as this change is automatic.

Questions or Feedback?