Fuel for the region's economic engines.

There are two characteristics required to own a business in the Kootenay / Boundary area: Courage and the ability to adapt on the fly. Everything else is fuel including your expertise or imagination and money. StellerVista is a local financial institution that understands those local truths. You bring the expertise and character, we’ll bring the knowledge and experience you need to drive and adapt your business in a financial successful way. In the grand scheme of big banks, we're more like you - a comparatively small business (with hundreds of millions of dollars to back us up). We make decisions here based on the local business conditions here. We know small business owners will face ups and downs, and we're here to guide you regardless of the challenge or opportunity. You be the engine. We'll provide the fuel.Business Chequing

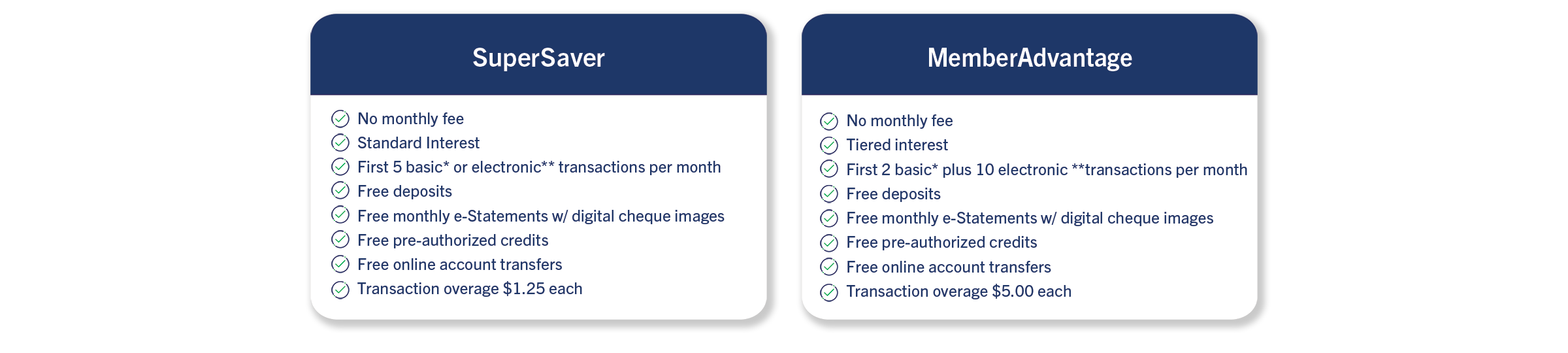

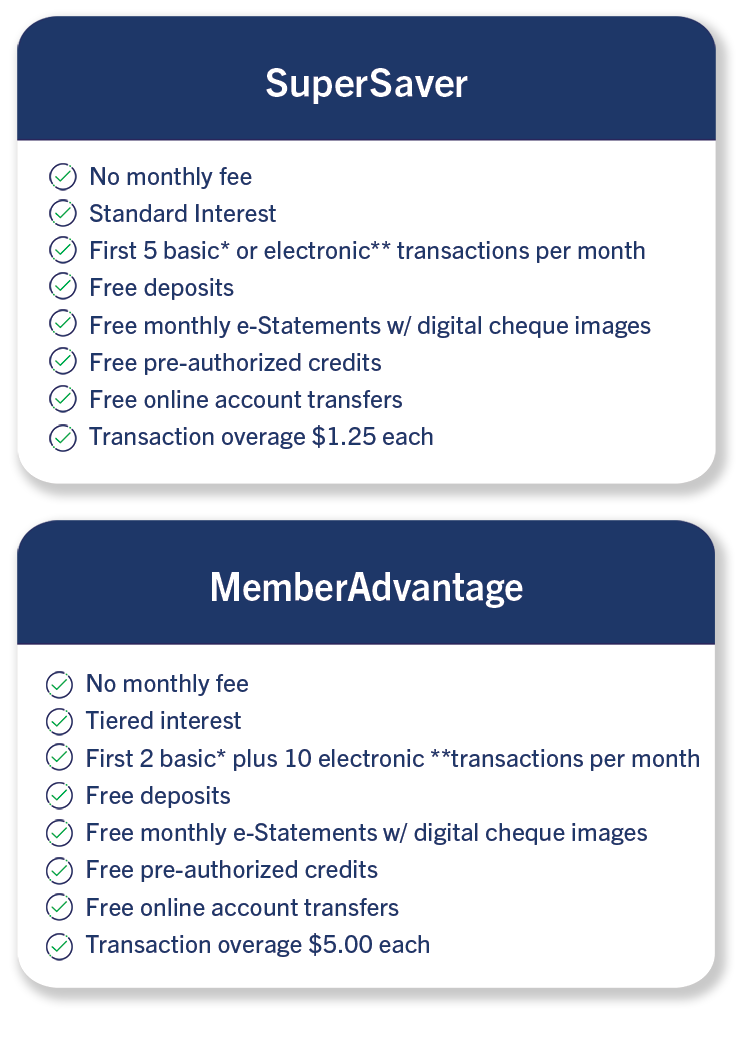

Business Savings

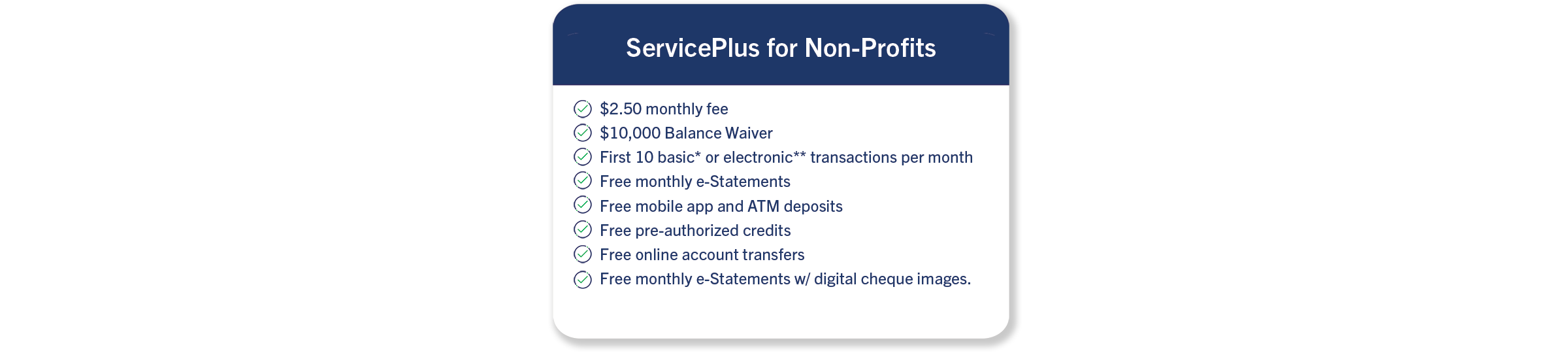

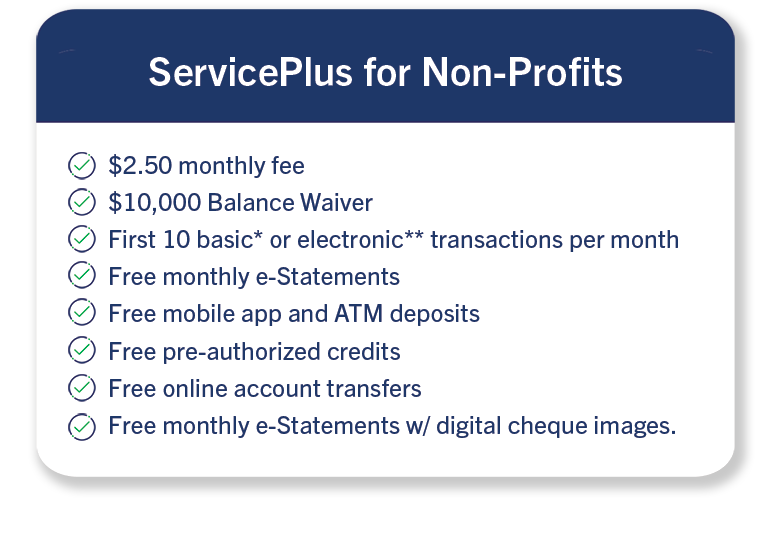

Non-Profit Banking

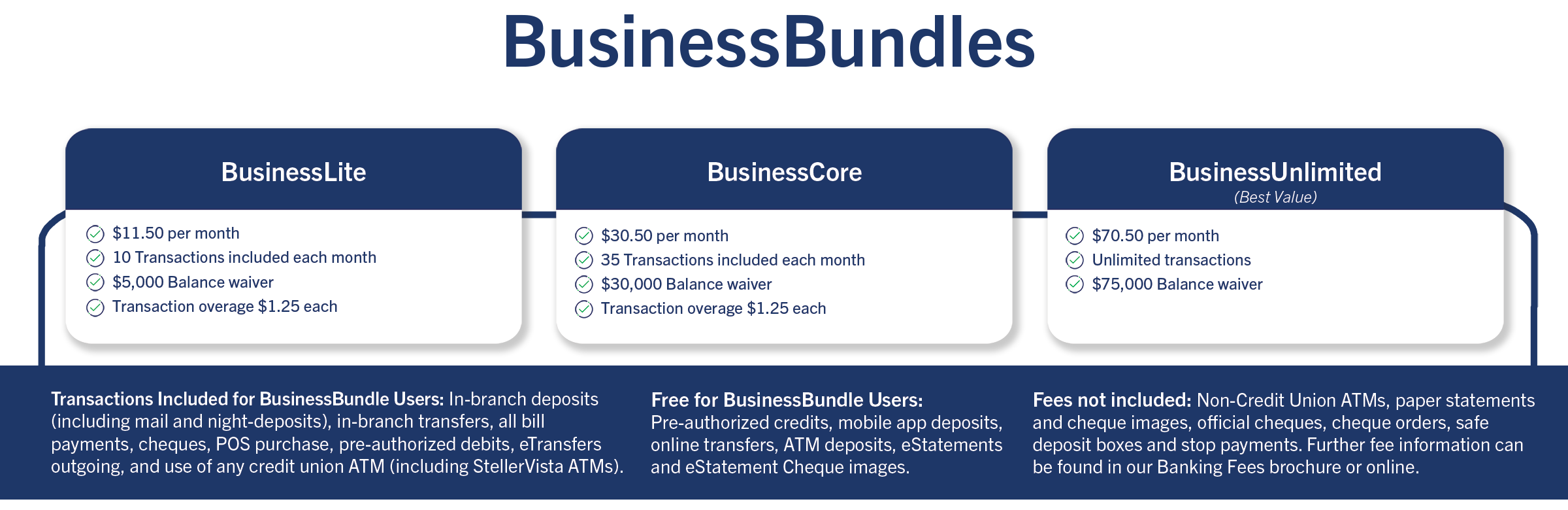

* Business transactions include: cheques, in-branch withdrawals/transfers, Point of Sale debits, StellerVista and other Canadian Credit Union ATM withdrawals, e-Transfers, deposits in-branch/mail/night deposit, online/telephone/mobile banking transactions, pre-authorized withdrawals.

** Electronic transactions include: StellerVista ATM, OTHER Canadian C.U. ATMs, Direct payment (POS), auto debits, transfers (ATM and online banking).

** Electronic transactions include: StellerVista ATM, OTHER Canadian C.U. ATMs, Direct payment (POS), auto debits, transfers (ATM and online banking).