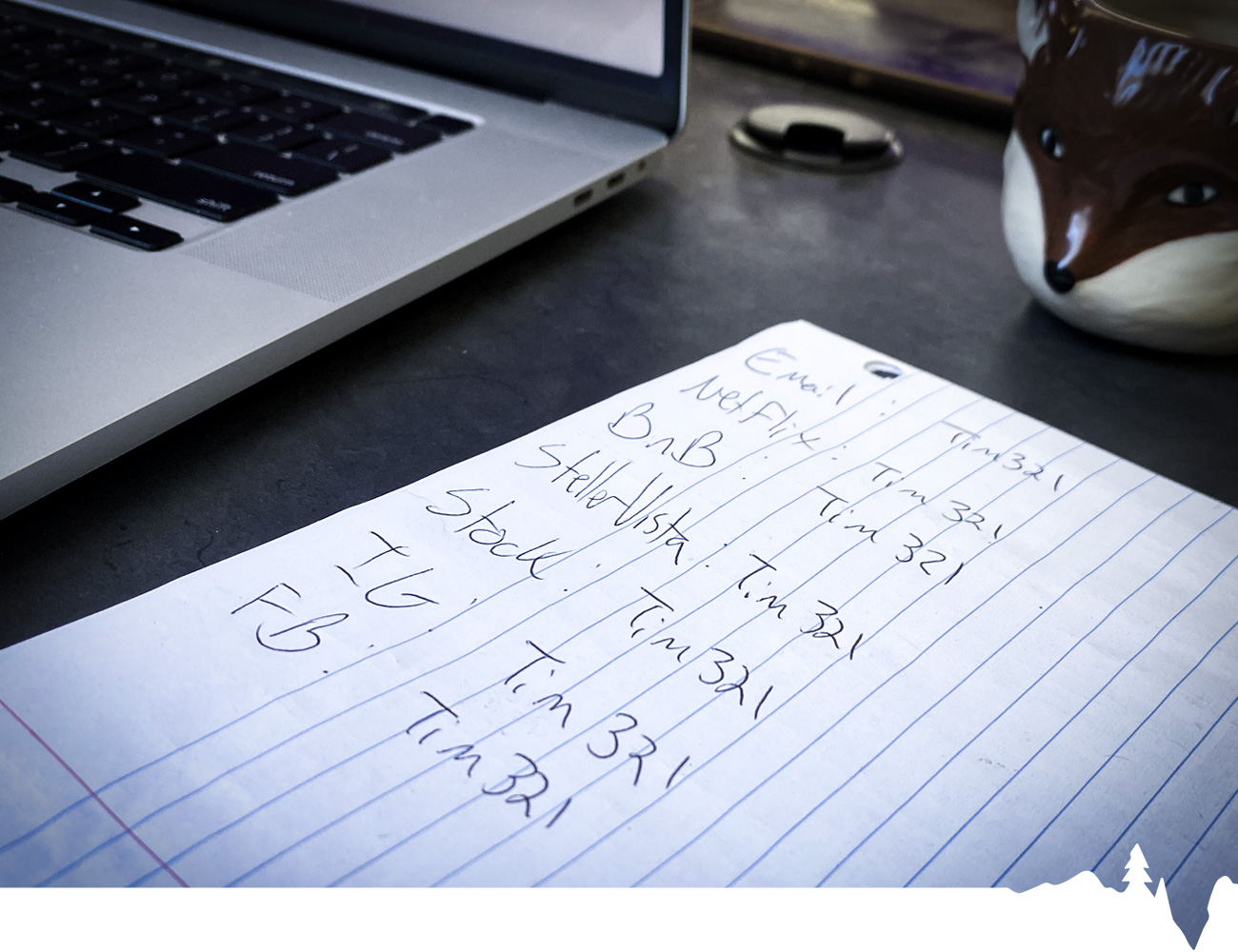

While this isn’t technically an online scam, it falls squarely under the umbrella of digital security, and it’s a good reminder of how quickly fraudsters adapt to new technology. Recently, some Canadians have reported a tactic known as “ghost tapping” or “tap card swapping.” It’s fast, subtle, and designed to catch people off guard during everyday transactions.

Here’s what you need to know – and how to keep yourself safe.

What Is Ghost Tapping?

Ghost tapping is a type of physical point-of-sale fraud where criminals trick someone into tapping their payment terminal, but the tap isn’t actually going toward the purchase the person is trying to make. Instead, the fraudster manipulates the situation so the victim unknowingly taps a device associated with the scammer, allowing an unauthorized payment.

This can happen in a few ways:

🔹 A fraudster brings their own mobile terminal or contactless reader close enough for someone to tap without realizing it.

🔹 A criminal distracts the victim by placing their own device near a legitimate terminal, making it look like a normal tap interaction.

🔹 Someone posing as a vendor “helps” with the tap by holding a machine, but it isn’t the merchant’s machine at all.

No PIN is entered, and the transaction appears seamless… which is exactly the problem.

Why It Works

Ghost tapping succeeds because tap payments are designed to be quick and convenient. Most of us have developed the habit of tapping without thinking – especially for small purchases.

Fraudsters take advantage of:

🔸 Busy environments (markets, festivals, street vendors, busy stores)

🔸 Split-second distractions

🔸 Assumptions of trust (“They’re behind a table, so they must be the vendor”)

🔸 People tapping without checking the screen first

Like other digital-security threats, ghost tapping works because it blends into our daily routines.

What Ghost Tapping Isn’t

To help clear things up:

🔹 It doesn’t involve someone wirelessly lifting your card number from your wallet, that’s a myth.

🔹 It doesn’t involve hacking your debit card chip.

🔹 It doesn’t bypass normal payment limits.

The scam only works when a fraudster gets you to physically tap their device.

How to Protect Yourself

A few small habits go a long way in preventing this type of fraud.

✔️ Always look at the terminal before tapping

Check the dollar amount, the screen, and whether the terminal is actually a merchant’s device.

✔️ If someone hands you a point-of-sale machine, take it in your own hands

Don’t tap a machine someone is holding up toward you. It should be placed on the counter or firmly in your possession.

✔️ Be cautious in busy or pop-up environments

Farmer’s markets, events, and festivals are great, but they’re also prime targets for distraction scams. Take an extra second to confirm the device.

✔️ Use mobile wallets when possible

Apple Pay, Google Wallet, and Samsung Pay tokenize your card number, adding an extra layer of protection.

✔️ Monitor your account regularly

Check your transactions after outings and enable account alerts through online or mobile banking.

✔️ If something feels rushed or odd, pause

Fraudsters rely on speed. Slowing down makes the scam much harder to pull off.

What To Do If You Think You Were Targeted

If you suspect an unauthorized tap transaction:

1️⃣ Contact StellerVista right away so we can help investigate and protect your account.

2️⃣ Review recent transactions carefully, noting anything unexpected.

We’re here to support you and most fraudulent transactions can be resolved when reported quickly.

Staying Safe Is a Team Effort

Digital and physical fraud techniques continue to evolve, but staying informed is one of the best tools we have. By taking a moment to verify each tap, you reduce the risk of falling victim to ghost tapping and other point-of-sale scams.

If you ever have questions about security, or something just doesn’t feel right, our team at StellerVista is always happy to help.